What is Making Tax Digital (MTD)?

HMRC has brought Making Tax Digital as an initiative toward establishing one of the most digitally advanced tax administrations in the world. It is aimed at transforming tax administration to make it more effective, efficient, and easier for taxpayers.

Making Tax Digital for VAT becomes mandatory for businesses with a turnover above the VAT threshold of £85,000 and optional for businesses below this threshold from April 2019. HMRC looks forward to widening the scope of Making Tax Digital by April 2020.

If your enterprise falls under the mandatory category of Making Tax Digital for business, then you need to maintain digital records. The HMRC authorised Making Tax Digital for VAT submission software will ensure that you are compliant for the future.

Read MoreBoost Transparency and Accuracy of Your Making Tax Digital for Business Records with SAP’s Harmonised Solutions

SAP Business One Version Release for Customers

June 2018

Pilot ProgramSAP Business One team starts pilot API testing with HMRC

September 2018

Demo to HMRCHMRC/SAP Business One pilot test project continues and development in progress

Autumn

Preview Program (Beta)Selected SAP Business One customers and VAT registered to join trial program

December 2018

Release for CustomersSAP Business One 9.3 PL08 to contain key enhancements for MTD readiness

April 2019

MTD DeadlineVAT registered and above VAT Threshold (£ 85,000) filed online

VAT Return with SAP Business One

SAP Business One for Advanced Compliance Reporting enables you to

Monitor your legal compliance reporting on a global scale through a single, unified dashboard – and get full audit traceability.

Use flexible business rules and an extensible report design environment to comply with constantly changing legal requirements.

Get support for on-time global compliance with multiple legal reporting formats and direct submission to regulatory authorities.

SAP Business One Solution Benefits for Making Tax Digital

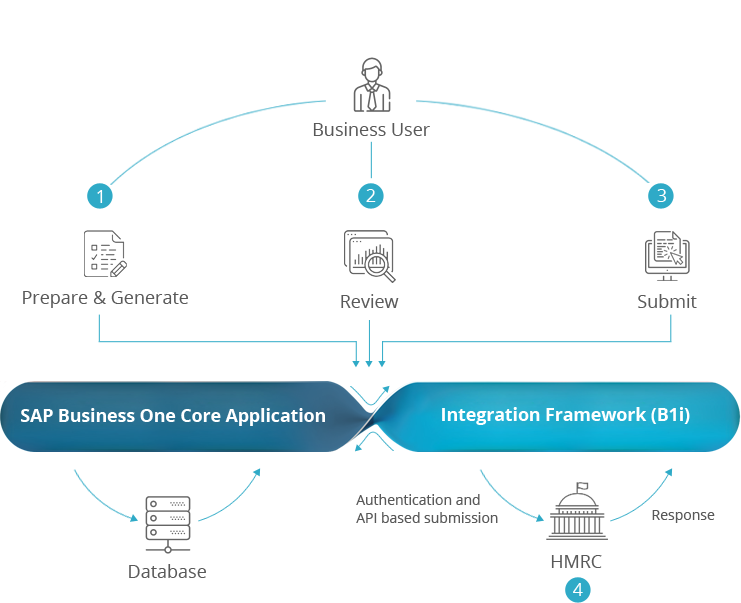

Automated end-to-end MTD for VAT reporting process from single solution

Supports direct submission of VAT return to UK HMRC via HMRC’s API standard

Stay compliant on time, through easy adoption of legal changes

Monitor legal reporting status with a dashboard

Digitised storing of transactions and records in different places and digitised transfer between the source systems, enabling the digital link as outlined by HMRC